Brazos Midstream announced the completion of several significant milestone projects consisting of major new-build pipelines and processing facilities located in the core of the Midland Basin, one of the most active oil and gas producing regions in the United States.

More

Press Releases

Brazos Midstream Announces Significant Milestones in Buildout of New Midland Basin Gas Gathering and Processing System

| Brazos Midstream

Brazos Midstream Completes Issuance of New $800 Million Senior Secured Term B Loan

| Brazos Midstream

Brazos Midstream announced that its subsidiary, Brazos Delaware II LLC, has completed the issuance of a new $800 million senior secured Term Loan B due February 2030. The Company used the net proceeds from the Term Loan, along with excess balance sheet cash, to repay its existing $830 million Term Loan B due May 2025. As part of the transaction, Brazos has also increased its currently undrawn super-priority revolving credit facility to $150 million from $90 million and extended the facility’s maturity date to 2028.

Brazos Midstream Announces Delaware Basin Acquisition and New Venture in Northern Midland Basin

| Brazos Midstream

Brazos Midstream announced two significant transactions in the Permian Basin region of West Texas. Brazos Delaware, LLC acquired the Pecos Gas Gathering System (Pecos) from Diamondback Energy, Inc. (Diamondback) and its midstream affiliate Rattler Midstream (Rattler). Additionally, newly-formed Brazos Midland, LLC has closed on the acquisition of Diamondback’s Mustang Springs Gas Gathering System, dba Permian Gathering, LLC (Mustang Springs).

Brazos Midstream Announces Extension of Delaware Basin Gathering System to Support Processing Agreement with Shell Exploration & Production

| Brazos Midstream

Brazos Midstream announced it has executed gathering and processing agreements with Shell Exploration & Production to construct a new natural gas gathering system located in the core of the Delaware Basin. Brazos’ new midstream infrastructure is anchored by fifteen year, fee-based acreage dedications totaling 55,000 acres in Loving, Ward, and Winkler counties. Brazos will construct 16 miles of high-pressure pipeline that will extend from the Company’s existing gathering and processing systems and can be expanded further to support multi-well pad development by current producer customers, as well as other producers in the area.

Williams and Brazos Midstream Announce New Strategic Joint Venture in the Permian Basin

| Brazos Midstream

Williams (NYSE: WMB) and Brazos Midstream announced that they have agreed to enter into a joint venture (the “Partnership”) in the Delaware Basin. Under terms of the agreement, Williams will contribute its existing Delaware Basin assets to the Partnership, in exchange for a 15 percent minority position in the joint venture. The contribution of the Williams assets will expand the footprint of the current Brazos system and the combined capabilities of the Partnership will provide existing and prospective customers with an enhanced suite of services.

Brazos Midstream Completes Sale of Delaware Basin Subsidiaries to Morgan Stanley Infrastructure

| Brazos Midstream

Brazos Midstream Holdings, LLC and Old Ironsides Energy today announced the completion of its previously announced sale of the Company’s Delaware Basin subsidiaries to a subsidiary of North Haven Infrastructure Partners II (“NHIP II”) for $1.75 billion. NHIP II is an investment fund managed by Morgan Stanley Infrastructure (“MSI”). The transaction included committed debt financing of $950 million ($900 million of term loan and $50 million of revolving credit facility), underwritten and arranged by Jefferies Finance LLC and Royal Bank of Canada.

Brazos Midstream Agrees to Sell Delaware Basin Subsidiaries to Morgan Stanley Infrastructure for $1.75 billion

| Brazos Midstream

Brazos Midstream Holdings, LLC and its financial sponsor, Old Ironsides Energy, announced they have entered into a definitive agreement to sell its Delaware Basin subsidiary companies to North Haven Infrastructure Partners II (“NHIP II”) and related funds for approximately $1.75 billion in cash. Closing is expected in the second quarter of 2018 and is subject to customary approvals and closing conditions.

Brazos Midstream Acquires Callon Petroleum Company’s Natural Gas Gathering System in Southern Delaware Basin

| Brazos Midstream

Brazos Midstream Holdings, LLC announced that subsidiaries of The Company have closed on the purchase of a natural gas gathering system from Callon Petroleum Company (NYSE: CPE) (“Callon”). As part of the acquisition, Brazos signed a long-term, fee-based agreement with Callon for gas gathering and processing services for acreage under development in Ward and Pecos counties, one of the premier areas of the Southern Delaware Basin. Including the Callon dedication, Brazos’ midstream infrastructure is anchored by long-term acreage dedications covering approximately 240,000 acres with top-tier Permian operators.

Brazos Midstream Announces Expansion of Credit Facility to $150 Million

| Brazos Midstream

FORT WORTH, TEXAS – Brazos Midstream Holdings, LLC announced that its subsidiary, Brazos Delaware LLC, has completed an expansion of its senior credit facility to $150 million in commitments from a syndicate of banks. Additionally, the facility has an accordion feature, which can expand total commitments to $200 million. These funds support the ongoing expansion of Brazos’ crude gathering and natural gas gathering and processing systems in the Southern Delaware Basin, one of the most active oil and gas producing basins in the United States.

Brazos Midstream Announces New Growth Projects in Southern Delaware Basin

| Brazos Midstream

Brazos Midstream Holdings, LLC announced the completion of multiple crude oil and gas gathering and processing projects in the southern Delaware Basin, one of the most active oil and gas producing basins in the United States. Brazos commenced operation of a new 60 million cubic feet per day (MMcf/d) natural gas processing plant (“Comanche I”), several new compressor stations and approximately 150 miles of large diameter, low and high-pressure gas gathering pipelines. The project also included the construction of 35 miles of crude oil gathering pipelines, two crude oil storage terminals with a combined capacity of 50,000 barrels (bbls) and connections to multiple downstream crude oil pipelines.

Brazos Midstream and Old Ironsides Partner to Pursue Midstream Investments

| Brazos Midstream

Fort Worth-based Brazos Midstream Holdings, LLC announced that it has partnered with Old Ironsides Energy, LLC, a leading independent oil and gas investment manager, to pursue the acquisition and development of midstream assets in the United States. The Brazos management team possesses broad energy experience across all commodities and throughout a variety of onshore U.S. basins and will initially focus on the development of crude and natural gas gathering, treating and processing assets.

Media

Midstream Roundtable: New Narrative, New Opportunities

Oil and Gas Investor

Read PDF

Brazos Midstream: A Decade of Transformative Growth in the Permian Basin

The Business Press

Read PDF

Brazos Midstream Advancing Permian Infrastructure Expansion Amid Waha Natural Gas Price Collapse

Natural Gas Intelligence

View Online

Giving You The Best That I Got - A New Gas Gathering And Processing Network In The Midland

RBN Energy

View Online

Oil and Gas Investor 40 Under 40: Jody Jordan

Oil and Gas Investor

Read PDF

Brazos Midstream moves to accommodate Permian growth

Midland Reporter-Telegram

View Online

Oil and Gas Investor 40 under 40: Geoff Cole

Oil and Gas Investor

Read PDF

Oil and Gas Investor 40 under 40: Stephen Luskey

Oil and Gas Investor

Read PDF View Online

Have it All, Part 13 – Brazos Midstream’s Crude Gathering System in the Delaware Basin

RBN Energy

View Online

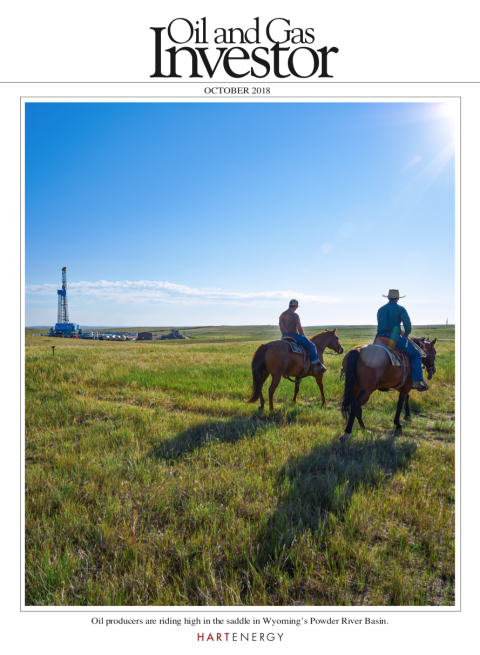

Going With the Flow

Oil and Gas Investor

Read PDF

The Jaggis: Midstream’s Family Affair

Oil and Gas Investor

Read PDF View Online

Priority Provides Integrated Electric Delivery and Supply Solution to Brazos Midstream

Business Wire

View Online

Cryogenic Gas Processing Plants Cropping Up Throughout Basin

Midland Reporter-Telegram

Read PDF View Online

Honeywell to Provide Third Cryogenic Gas Processing Plant to Brazos Midstream

PR Newswire

View Online

Oil and Gas Investor 40 Under 40: Brad Iles

Oil and Gas Investor

Read PDF View Online

Gas Processors Are on the Fast Track

Hart Energy

Read PDF

Midstream investment in Delaware continues

Midland Report-Telegram

Read PDF View Online

Brazos’ Midstream Strategy Includes Compression

Pipeline & Gas Journal

Read PDF

The CFO’s Dilemma

Midstream Business

Read PDF

Fort Worth Company Puts Focus on Delaware Basin

Fort Worth Business Press

Read PDF

Building Up in the Delaware Basin

Oil and Gas Investor

Read PDF

Delaware Basin Buyers Club

Oil and Gas Investor

Read PDF